COSMOPOLITE GROUP

OUR SERVICES

ABOUT

Cosmopolite is present in France, Belgium and the Netherlands, and has sales offices in the United Kingdom and the United States. Cosmopolite serves more than 300 of the world’s leading clients in 29 countries.

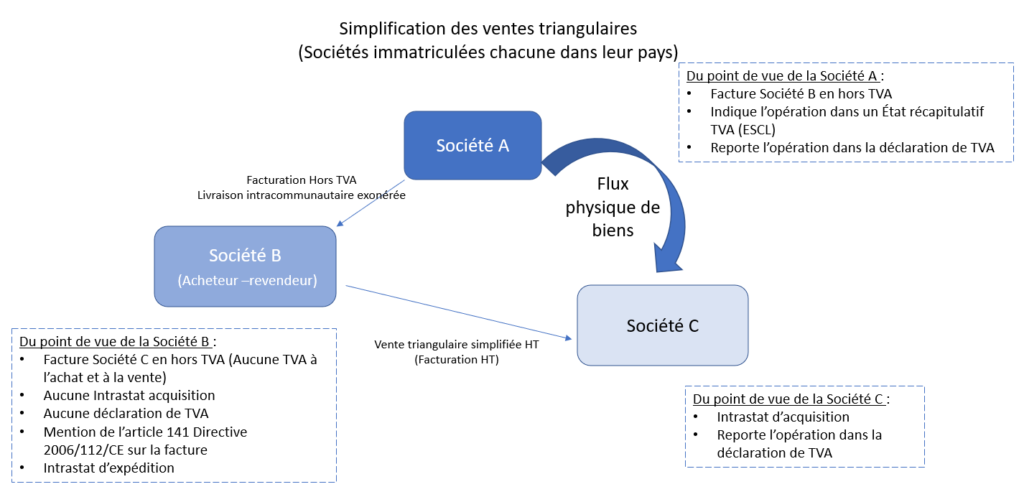

A triangular operation exists when three companies established in three different EU countries are involved in the same physical flow of goods.

Simplification measures for these triangular operations are provided for by Article 141 of Directive 2006/112/EC of 28 November 2006, thanks to which the so-called “interlayer” company escapes VAT.

These operations are complex as regards to the treatment of VAT and the particulars to appear on invoices…

In which case do you need to set up a fiscal representation?

You are part of a project including triangular operations (manufacturing – delivery – invoicing issued by different subsidiaries of a group) in some countries of the EU as well as Great Britain, Norway and Switzerland….

The VAT aspects relating to transactions carried out in several European states, often organized between different subsidiaries of large groups, are strategic elements of great importance.

Also known as “triangular operations“, the distribution of goods entering the different Member States, with several destinations and stakeholders, must be taken into account very early in the process.

With the establishment of a fiscal representation, COSMOPOLITE will help you throughout your sales process to be in compliance with the complex VAT regulations.

In order to be able to apply the simplification measure, it is necessary that companies A, B and C are identified for VAT purposes in their respective countries, and that company B as buyer/reseller is not registered either in the country of departure or in the country of destination of the goods. This is also applicable when company B is an entity outside the European Union registered in a Member State other than the country of departure and the country of arrival.

With this simplification, company B is not liable for any VAT on the purchase and sale.

It should be noted that this simplification regime is not mandatory and, if one of these conditions is not met, the operators concerned must apply the rules set out in the 1991 Directive.

Cosmopolite is present in France, Belgium and the Netherlands, and has sales offices in the United Kingdom and the United States. Cosmopolite serves more than 300 of the world’s leading clients in 29 countries.