CBAM : The Carbon Border Adjustment Mechanism

CBAM... Are you ready for the first statement?

The Carbon Border Adjustment Mechanism (CBAM) is a key component of the European Union’s (EU) Fit for 55 climate package.

The aim is to reduce net greenhouse gas emissions in the EU by 55% by 2030, in order to achieve carbon neutrality by 2050.

CBAM : Cosmopolite is here to help!

The CBAM limits “carbon leakage” by aligning the carbon price paid for products imported into the EU with the carbon price paid for EU products. Carbon leakage occurs when, due to costs related to climate policies in the EU, companies shift their production to third countries with lower environmental bids, or replace equivalent (less carbon-intensive) EU products with imports from these third countries. With the CBAM, companies importing into the EU will have to buy CBAM certificates to offset the difference between the price of carbon allowances in the EU GHG Emissions Trading System (EU ETS) and the carbon price paid in the third country of production. This will result in the same carbon price for each tonne of GHG emissions for both European and imported products. In parallel with the ramp-up of the CBAM, the free emission allowances enjoyed by the sectors concerned in the EU will be phased out.

The CBAM will initially cover products from six pilot sectors (iron and steel, aluminium, cement, fertilisers, hydrogen, electricity), some ‘near’ downstream products (containing almost 100% iron and steel and/or aluminium) and some precursors (raw materials used to manufacture the covered products). These sectors were selected for their high carbon intensity and exposure to international competition, characterising their exposure to the risk of carbon leakage. The CBAM will cover direct emissions from these products (related to the production process) as well as indirect emissions (related to the production of electricity needed for production) from certain products (cement and fertilizers).

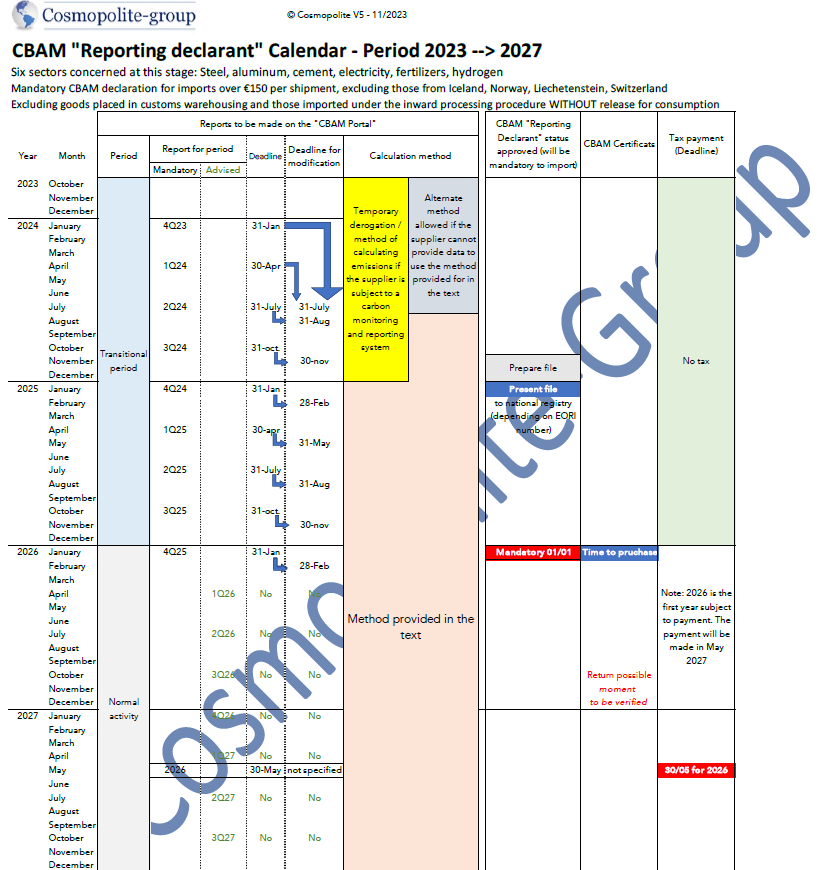

The CBAM Regulation provides for the implementation of the mechanism from 1 October 2023, as part of a “blank” transition phase until the end of 2025. During this phase, importers will only be subject to reporting obligations, with no financial adjustment applied to their imports. The CBAM will then gradually increase over 9 years, from 2026 to 2034, in parallel with the gradual reduction of free allowances in the EU ETS for the sectors covered.

Companies in these very first sectors must therefore document all their procurements now in order to be able to effectively make the first declaration in January 2024.

What does it mean to "document"?

For each imported product or even each component of imported products, the company will have to be able to indicate the technological level of the production units, for example:

- Quantities imported

- Information about the production site

- Production Process Used

- Direct and indirect emissions associated with commodities

- Details of the calculation method used and the possible use of default values

- Carbon price already paid in the country of origin

- Additional information depending on the product (e.g. clinker content)

COSMOPOLITE, due to its long experience in Customs Clearance, is here to support you and help you :

- Search for data from non-EU suppliers

- Concentrate data from multiple import locations

- Make your first declaration (for the fourth quarter of 2023)

- Register as an “Authorised CBAM Registrant”

- Acquire and manage your certificates

- Manage the timing of CBAM obligations

- Possibly, accompany you during your discussions with the Administration

We act strictly as a service provider.

Do not hesitate to contact us: info@cosmopolite-group.com